About us - anbcapital

anb capital's activities include dealing in securities, arranging corporate finance transactions, advising clients on investments, maintaining custody of securities, managing our clients’ investments, and managing funds that invest in different types of securities or asset classes. anb capital commenced its operations in January 2008 and our paid-up capital as of 30 June 2022 was SAR 1,000 million.

We offer a full spectrum of investment services, conventional and Shariah-compliant, to all client categories including private & institutional investors. We strive for excellence in achieving our clients' objectives, which in turn requires continuous investment in our people and infrastructure, leading to long-term growth in profitability for our shareholders.

We are headquartered in Riyadh with investment centers located across the Kingdom.

Dear Valued Stakeholders,

Thank you for your continued trust and engagement. As we reflect on 2024, I am pleased to share that anb capital achieved several significant milestones—demonstrating resilience, growth, and unwavering commitment in a volatile global environment. Your support has been instrumental to our success, and I remain confident in our strategic direction as we step into 2025.

Financial Performance

We built upon our momentum from previous years, delivering a robust financial performance. Operating income rose by 26% year-on-year to SAR 486 million, supported by growth across all business lines. Net income before Zakat and income tax reached SAR 464 million, up from SAR 271 million in 2023, driven by strong operational performance and successful investment exits. Net profit after Zakat and income tax grew by 81% to SAR 400 million, reflecting the strength of our platform and the discipline of our execution.

Investment Banking

Our Investment Banking division sustained its strong trajectory, advising on landmark transactions that reflect our expanding role in the Kingdom’s capital markets. Notable mandates completed in 2024 included:

• Advising Tamimi Markets and the Public Investment Fund on the acquisition of Alraya Supermarkets

• Advising on a private equity placement in Al Tazaj restaurant chain

• Advising Jabal Omar Development Company on a major debt-to-equity conversion

• Serving as Joint Bookrunner and Co-Underwriter for the Fakeeh Care Group IPO

• Acting as Co-Lead Manager and Co-Underwriter for Savola’s rights issue and distribution of Almarai shares as dividends

• Acting as Joint Bookrunner and Joint Lead Manager for Cenomi Centers’ Sukuk issuance

We will continue to originate and execute high-value transactions, further strengthening our team, capabilities, and market presence.

Asset Management

We continued to expand our product offering in 2024, launching innovative solutions to meet our client’s evolving investment needs. We launched the Digital & IT Equity Fund, targeting capital growth through investments in companies benefiting from digital transformation and infrastructure investment. The fund was recognized as the Best Innovative Investment Fund in the Saudi Stock Market for the year 2024 by Sanadeq.

Additionally, we introduced two private fixed income funds and two public multi-asset funds, offering our clients a broader range of strategies aligned with their goals.

Our equity funds ranked among the top performers on the Saudi Stock Exchange—a testament to our disciplined investment process, market insight, and the dedication of our asset management team.

Real Estate

2024 was a landmark year for our real estate business. We launched nine new funds, increasing AUM from SAR 12.2 billion to SAR 18.4 billion—a 51% increase. These included infrastructure, residential, and mixed-use developments in Riyadh and Jeddah, reinforcing our footprint in core urban markets.

We also exited funds totaling SAR 4 billion, including the Al Arabi Al Arjan Real Estate Development Fund I and the ANBC Business Gate Fund—which managed the iconic Business Gate Complex and Fairmont Hotel in Riyadh—demonstrating our ability to deliver value through timely execution and strategic foresight.

Looking ahead, we are expanding into warehousing and industrial developments, sectors critical to Saudi Arabia’s economic diversification. Our focus remains on high-impact, Vision 2030–aligned investments that generate lasting value for our clients.

Capital Markets

This year marked a turning point in our digital brokerage experience. We launched a new trading interface, inspired by the best global platforms—designed for simplicity, speed, and intuitive execution. Continuous updates ensure our clients remain at the cutting edge of trading technology.

We also launched our Sell-Side Research offering, beginning with the Fakeeh Care Group IPO and expanding to cover key sectors including banking, healthcare, logistics, insurance, and software & services. Complementing this, we established our Institutional Sales & Trading desk, offering high-quality execution for complex institutional orders.

Looking Ahead to 2025

We are optimistic about 2025, as capital markets activity accelerates in line with Vision 2030 reforms, increased foreign participation, and ongoing digital transformation. We are well-positioned to capitalize on these trends across our investment banking, asset management, capital markets, and real estate platforms. Our focus remains on sustainable growth, client-centric innovation, and long-term value creation.

Our Commitment

At anb capital, our mission is to serve as a catalyst for economic development and a trusted partner in your financial journey. We are committed to the highest standards of integrity, transparency, and excellence in everything we do.

Thank you once again for your continued loyalty and confidence. We look forward to shaping the future together in 2025 and beyond.

Warm regards,

Khalid Saleh Alghamdi

CEO and Board Member

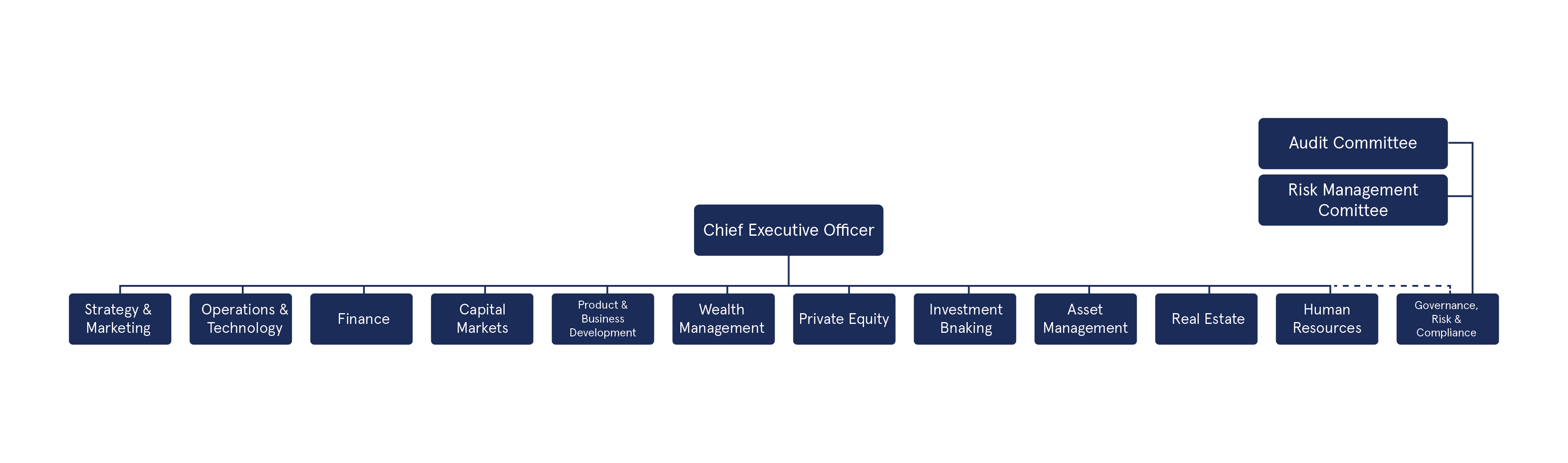

Comprising leaders from the Saudi business landscape, our board oversees strategy formation, provides guidance to the Executive Management, and brings industry insights and relationships to us that have proven to be invaluable over time.

Our leadership team drives a culture that facilitates employee empowerment and growth, as we truly believe that our people are the foundation of our success.

We pride ourselves on bringing together one of the best executive teams in Saudi Arabia and on recruiting best-in-class talent from the Kingdom and abroad. We boast a diverse and cosmopolitan culture where ideas are encouraged as we build investment management and financial structuring solutions for our clients.

We are committed to providing our employees with the professional development opportunities they need to build exceptional careers.

The success of our business is dependent on the quality, expertise and skills of our people. Our people are committed to our clients. Client confidence is earned through demonstrated performance and integrity at all times.